by Lufthansa Flyer | Dec 19, 2016 | Brussels, Corporate, Eurowings, Featured, Lufthansa |

Over the past few days, since Lufthansa’s announcement that it was acquiring the 55% stake that it did not already own in Brussels Airlines, I’ve seen a significant amount of negative opinion and commentary coming from various social media outlets. In seeing this disproportional ‘outcry’ against the deal, it prompted me to delve deeper into the ‘Pros and Cons’ of the deal and see where Brussels, along with the rest of the LH Group, go from here.

I reached out to my contacts at Brussels Airlines to gain their insights and compared that to what some of their passengers had shared. Kim Daenen, Media Relations Manager and Spokeswoman for the airline, was kind enough to take time away from her busy schedule to share some thoughts on the way forward for airline…..

Is Brussels Losing Its Belgianity To Lufthansa?

Brussels Airlines will continue to be Brussels Airlines. They fit a unique niche and offer a route map that was lacking at Lufthansa and it is this uniqueness that made them attractive enough to have LH acquire the entire airline . In all the years that Brussels has existing since having Lufthansa and Virgin as their major stake holders, have you seen any of their ‘fingerprints’ on the airline? Of course not. This ‘hands off’ off style is not at risk of being augmented just because Lufthansa Group became the sole shareholder.

In fact, according to Brussels Airlines Kim Daenen, ‘We would have not existed today if LH hadn’t bought 45% shares back in 2008. Thanks to their investments we have grown our long haul fleet from 3 to 10 aircraft. They have been a trustworthy partner.’

Daenen continued to talk about why this deal has made sense for Brussels Airlines in the pat and will continue do make sense going forward: “LH has always had the right to force decisions on us by veto in the board and has never done so in the past 8 years, showing that they respect and trust our management, and they will continue to do so. Look at their other integrations like Austrian and SWISS, they still have their own independence. We are happy that we have moved from being a guest at the Lufthansa Group table, to being a real family member, which will allow us to grow (thanks to synergies and a stronger position in the market, we’ll have more negotiating power now that we’re part of a big group and this will cut costs enormously). For the customer it will only get better. LH Group really is the right partner for us.”

How are Brussels Airlines passengers reacting to the news?

First off, this is not ‘NEWS’. Lufthansa has had the option to purchase the remaining 55% it had not already owned since Lufthansa since making its initial investment in 2008. There is no surprise here. In fact Lufthansa has been talking throughout 2016 that the plan was to complete the acquisition of the remaining shares in Brussels Airlines by year’s end.

Daenen adds, ‘Indeed, people seem to be stirred by the news, although it’s been a long time coming. That shows a lot of love for the brand, so in that respect it’s nice, but what they don’t seem to understand is that for us this was unavoidable. People (in Belgium) are afraid that a Belgian company is disappearing, but we weren’t 100% Belgian before neither. LH was already a 45% stakeholder and Virgin was the other big partner. Still, we kept our “Belgitude” alive and this will not change now with the 100% LH ownership. By the way, Brussels Airlines NV/SA remains a Belgian company, under Belgian law.‘

Does the Brussels Airlines brand go away?

Not at all. The whole idea behind eliminating the successful brand is not realistic. Why break something when it isn’t broken? The decision by Lufthansa to fully acquire Brussels Airlines was to bring a quality brand fully into the LH fold and allow them to continue to thrive. In fact it’s a similar approach to what was taken with SWISS and Austrian. The group is stronger because of the uniqueness and niches that each brand brings to the Lufthansa Group.

Daenen adds ‘Concerning the brand name: this will stay until we think there is a better path to follow. We are not forced to change to Eurowings, but like every good management should do we evaluate what the best solution would be. Like our CEO Bernard Gustin explained to the media yesterday: “A brand is not defined by shareholders, it is defined by the consumer. Brussels Airlines is a strong brand and it will remain unless we see an opportunity to create an even stronger, different identity, but that is an ongoing exercise that we anyway perform. We stay more Belgian than ever. Furthermore it is the values, the spirit and the employees of a company that matter, more than its name.” ‘

Becoming part of Eurowings will make Brussels Airlines a Low Cost Carrier like Ryanair?

No, Brussels Airlines will maintain its level of high quality passenger experience both on the ground and in the air. Just because they may have pricing models that mimic those of LCC’s, thats where the similarities end. Brussels Airlines has successfully adapted its commercial strategy in order to compete with the high low cost competition, so the products are similar to Eurowings.

According to Daenen, ‘ What’s very important to note: we do NOT become a low cost company. The public confuses a low-cost with low service, but actually lo-cost means having a very low cost structure. We already have the lowest cost structure of the entire LHG, because we had to compete with the highest low cost competition penetration in Europe (Brussels market: 40% of seats offered is low cost). Business models had to change and we did, BUT: we will never compromise on service. So we will continue to offer the service we do today. Actually our product is very similar to Eurowings already today.‘

Will Lufthansa’s 100% ownership stake remove Brussels Airline’s ability to operate independently?

Another idea that is not grounded in reality. Lufthansa has a track record of absorbing airlines into the LH Group but not forcing them to give up their identity and turn into white and blue aircraft with a bird on the tail. Look at the success stories at SWISS and Austrian. Neither of these airlines would have a strong chance at survival on their own, but when teamed together they are able to focus on maintaining their identity and operate with a very loose leash from LH. When you are aboard an LX or OS flight, do you see anything that suggests that Lufthansa is the stake holder? You don’t! Do SWISS and Austrian execute their own marketing strategies? Yes.

Will Brussels Airlines continue to be allowed to ‘think’ for themselves and execute initiatives that they feel are best for them? Of Course!

What does being a wholly owned unit of Lufthansa Group mean to Brussels Airlines?

It means that they will further benefit from the Economies of Scale when it comes to operational efficiencies.

Being a full member of the LH Group, they will benefit from improved cost structure when it comes to thing such as fleet expansion, fuel expenses, and effective integration of their IT platforms. The impact on the balance sheets will be a net positive from an operating perspective.

Daenen adds: ‘The synergies will allow us to invest more in digitalization, better services, better onboard product, fleet renewal (imagine negotiating with a lessor as Brussels Airlines vs. as a Lufthansa Group member. Second example: IT investments can be done for the entire group, instead of for every company separately).’

How does this affect Brussels Airlines’ Star Alliance membership?

Brussels Airlines will continue to be a Star Alliance member exactly in the manner that it has been up to this point. Passengers will be able to continue to earn and redeem miles for flights operated by Brussels Airlines.

by Lufthansa Flyer | Dec 15, 2016 | Brussels, Corporate, Eurowings, Featured, Lufthansa |

LUFTHANSA has announced that Brussels Airlines has become wholly owned by the Lufthansa Group and will join the Eurowings division. The arrangement is scheduled to be closed in January 2017 and full integration is expected by 2018. Lufthansa acquired the remaining 55% it did not own at a cost of 2.6 million Euros.

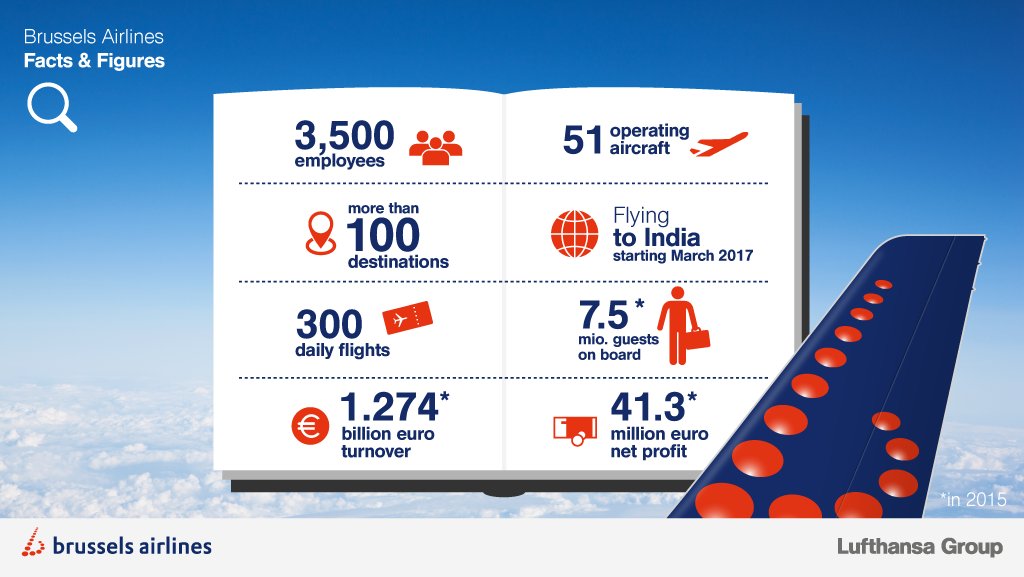

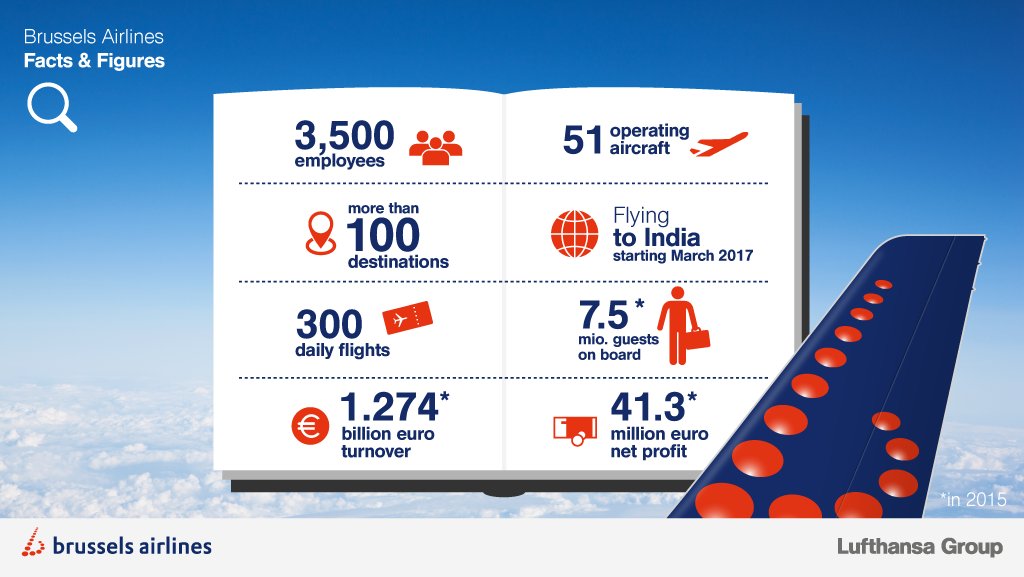

Quick facts regarding Brussels

According to LH, there will be no immediate changes to how Brussels operates, in fact it appears that things will remain the same for the foreseeable future due to the perfect complement that Brussels is to LH Group as far as routes and fleet are concerned. It is expected that Brussels will continue to fly to their 23 ‘long-haul’ and 79 ‘short-haul’ destinations.

The Brussels network

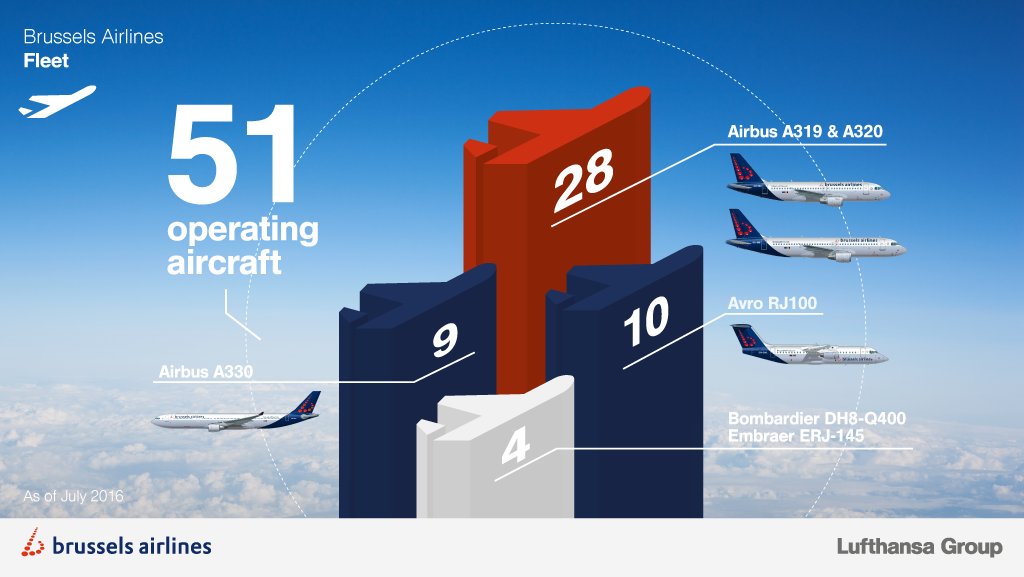

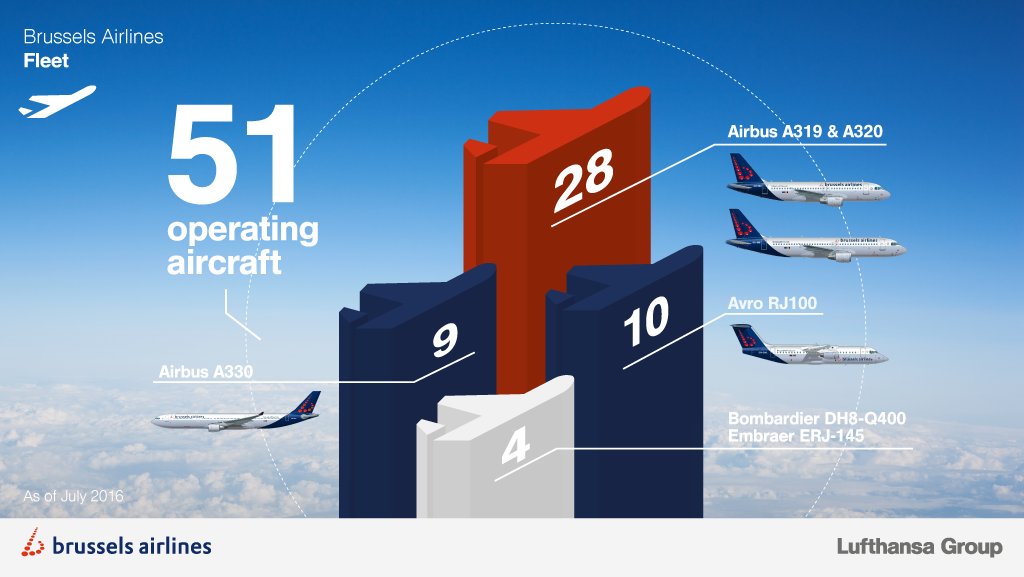

Becoming part of the Eurowings group will further expand Lufthansa’s presence into the low cost carrier market within Europe where they face significant competition from the likes of Ryanair and easy Jet. Being able to plug in 51 aircraft into Eurowings with immediate effect will certainly be to LH’s advantage.

Brussels fleet information

No plans have been announced as far as any significant livery changes. LH would rather ‘SN’ keep their unique and successful brand identity. The only change that we’ll see on the aircraft is a small footnote that Brussels is a member of ‘The Eurowings Group’. Changes to the reservation system and other passenger-based services are not immediately expected.

by Lufthansa Flyer | Nov 3, 2016 | Air Berlin, Airlines, Airports, Corporate, Etihad, Eurowings, Featured, Frankfurt, Germany, Industry News, Lufthansa |

Today was a busy news day for Lufthansa and not in a positive manner. Aside from an earnings report that was lackluster with future forecasts that were not overly optimistic, Ryanair announced something that will force a shift in how Lufthansa does business on its home turf.

It was perhaps not a coincidence, but on the same day that Lufthansa announced their 3rd quarter financial results, Ryanair announced that they would begin offering flights from Frankfurt. A place where Lufthansa controls over 60% of air traffic movements and also an airport in which LH owns an 8% share.

Ryanair in its announcement stated that 2 737 aircraft would be deployed beginning in March 2017 and will focus primarily on warm-weather holiday markets in and around the Mediterranean region. Ryanair expects to invest over $200 million dollars into this expansion that is specifically targeted at Lufthansa’s low cost carrier unit, Eurowings. Ryanair will now operate out of 9 German airports.

Plans for Eurowings never included operating in Lufthansa’s hubs in Munich and Frankfurt, but due to the ‘attack’ of LCC carriers upon Eurowings, Lufthansa had to relent and recently announced that in fact it would operate Eurowings out of Munich, and today they were forced to announce that Eurowings may also be coming to Frankfurt. This decision had to be made as a direct response to Ryanair’s action. LH didn’t provide specifics, simply because they were caught off guard by the Ryanair gambit. However, expect a Eurowings / Frankfurt announcement sooner than later.

WHY NOW FOR RYANAIR?

Previously, Ryanair avoided Frankfurt-Main (FRAPORT) like the plague choosing instead to operate out of Frankfurt-Hahn which is about 70 miles outside the city. Their CEO, Mike O’Leary, even went on record last year saying that Ryanair would never fly out of FRA. What prompted the change in strategy was the inducements that the Frankfurt Operating Authority offered Ryanair, including substantially reduced landing fees, gate expenses, and similar overhead. In all, Ryanair will pay 40% less than other airlines for the same services. FRAPORT said this was done as part of a new strategy of offering huge discounts in order to attract more airlines and routes. My question is where are you going to fit them when the airport is already at capacity and your dainty neighbors don’t want flights departing or arriving when the sun is below the horizon? But I digress……

Of course this irritated LH’s senior management who now are challenging their own business partner in FRAPORT to extend similar discounts to those already using the airport. This soap opera will get more interesting over the coming weeks as Lufthansa responds to the Ryanair announcement. But give credit where credit is due, Ryanair simply is taking advantage of an opportunity that was placed nicely onto its lap. FRAPORT has initially suggested that no deals will be made with existing carriers at Frankfurt, but I can’t see that remaining the case.

USED INSTEAD OF NEW…..

Also part of todays earnings commentary was an announcement that going forward, Lufthansa may opt to purchase used aircraft instead of new aircraft as it looks to replace aging aircraft in the short haul fleet (regional jets, etc). The rationale behind this decision is to reduce some of the capital expenditure as a result of softer earnings expectations. This does not affect any orders that Lufthansa has placed for new aircraft, it may just result in fewer orders for new aircraft. LH still plans to spend 2.2 – 2.7 billion dollars a year over the next 3-5 years as it takes delivery of new aircraft.

NO TO ITALY AND ALITALIA…….

As part of the same session today, LH Group CEO Carsten Spohr put to rest the rumors surrounding Lufthansa taking a stake in Alitalia as part of a larger deal to acquire Air Berlin. There had been conversations between Etihad (stakeholder in both Air Berlin and Alitalia), Alitalia, and Lufthansa about a potential 3-way deal that would have LH take a substantial stake in Alitalia, and in return Etihad would proffer Air Berlin. This plan was in addition to the existing plan that will have Lufthansa wet-lease 40 aircraft from Air Berlin and fly the planes the routes that those birds normally served. In his comments, and perhaps they were unscripted, but Spohr simply stated that the personal home that he owns in Italy is about as much as Lufthansa is going to invest in Italy. Hopefully a speechwriter doesn’t get a bonus for that wit.

‘IMHO’ (Brewing for a while!) ………

For this LH fan it’s become increasingly frustrating to see an Airline struggle in a business where by all reasonable measures, it should be the dominant player. It has allowed itself to be nickle-and-dimed into positions that it shouldn’t be in. It should have stepped up and fixed its labor woes years ago instead of suffering hundreds of millions in losses due to strikes as a result of unhappy labor. It would have been ridiculously more cost effective to settle with labor instead of being stubborn to bend to a compromise.

I think another mis-calculation was the decision to create some kind of super-LCC within the group. Thus far Eurowings has not proven itself as a successful model and the jury is still out as far as its viability is concerned. I’m hoping it works out because in theory EW would be a fantastic complement to the group but on the other hand I think Lufthansa has taken their eye off of what used to matter.

The successful Lufthansa paid attention to their best customers, took their advice to heart, and developed product and services based on what these passengers were asking and willing to pay for. With that commitment came a fierce loyalty from their best passengers. That has changed. No longer is Lufthansa actively soliciting the advice of ‘HON’ and ‘Senator’ level passengers. Instead they have turned their focus on the low-margin passenger who travels once or twice a year and wants to buy the cheapest seat possible. They’ve transformed marketing and social media campaigns to focus on the guy or gal who will pay €79 euro for a once in a lifetime trip from Stuttgart to Ibiza.

I’m no marketing expert, but I am well versed in reading corporate financials. When I see the priority being shifted to filling up an economy cabin with $400 fares instead of focusing on the far more loyal, and far more profitable, premium cabin passenger, it comes as no surprise to see Lufthansa struggling on the balance sheet. They keep referring to a challenging operating environment but other carriers seem to do well in the same environment. A few years ago, fuel expense was the scapegoat. Now the scapegoat-du-jour appears to be the fierce competition coming from LCCs. Eventually the list of rationalizations is going to run out. The challenges to Lufthansa’s success are within the airline, not outside of it.

Focus on your best passengers. They’re the ones that will determine success or failure for any carrier.